boulder co sales tax efile

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. City of Longmont Sales Tax Rates.

Business Process Outsourcing Business Process Outsourcing Bpo Business Process

Boulder Countys tax rate is 0985.

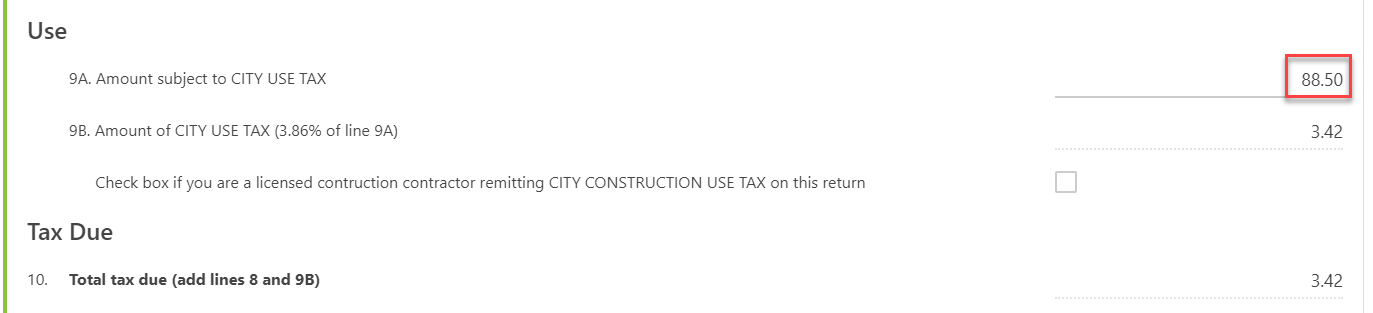

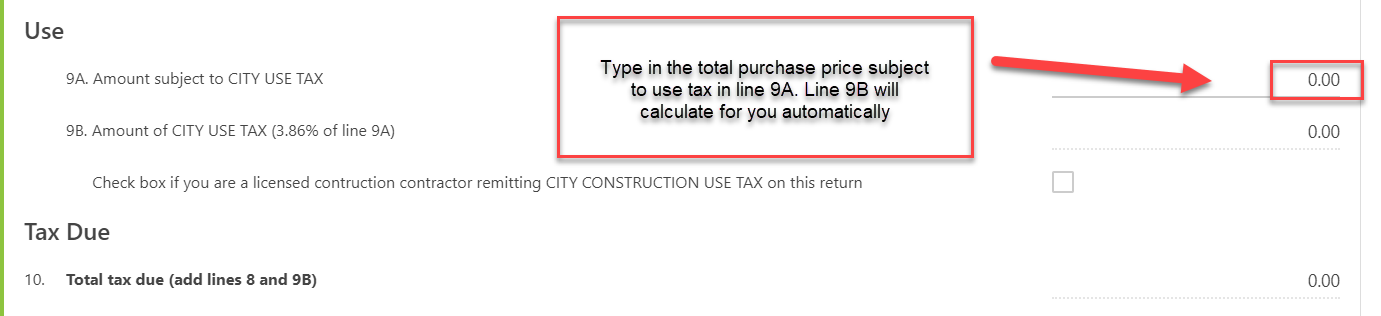

. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax. The Boulder County sales tax rate is. The Colorado sales tax rate is currently.

10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. County road and transit improvements. Creating a User is secure and easy-.

Colorado Tax Lookup Tool. Total Boulder County tax rate. Follow the New User Registration button.

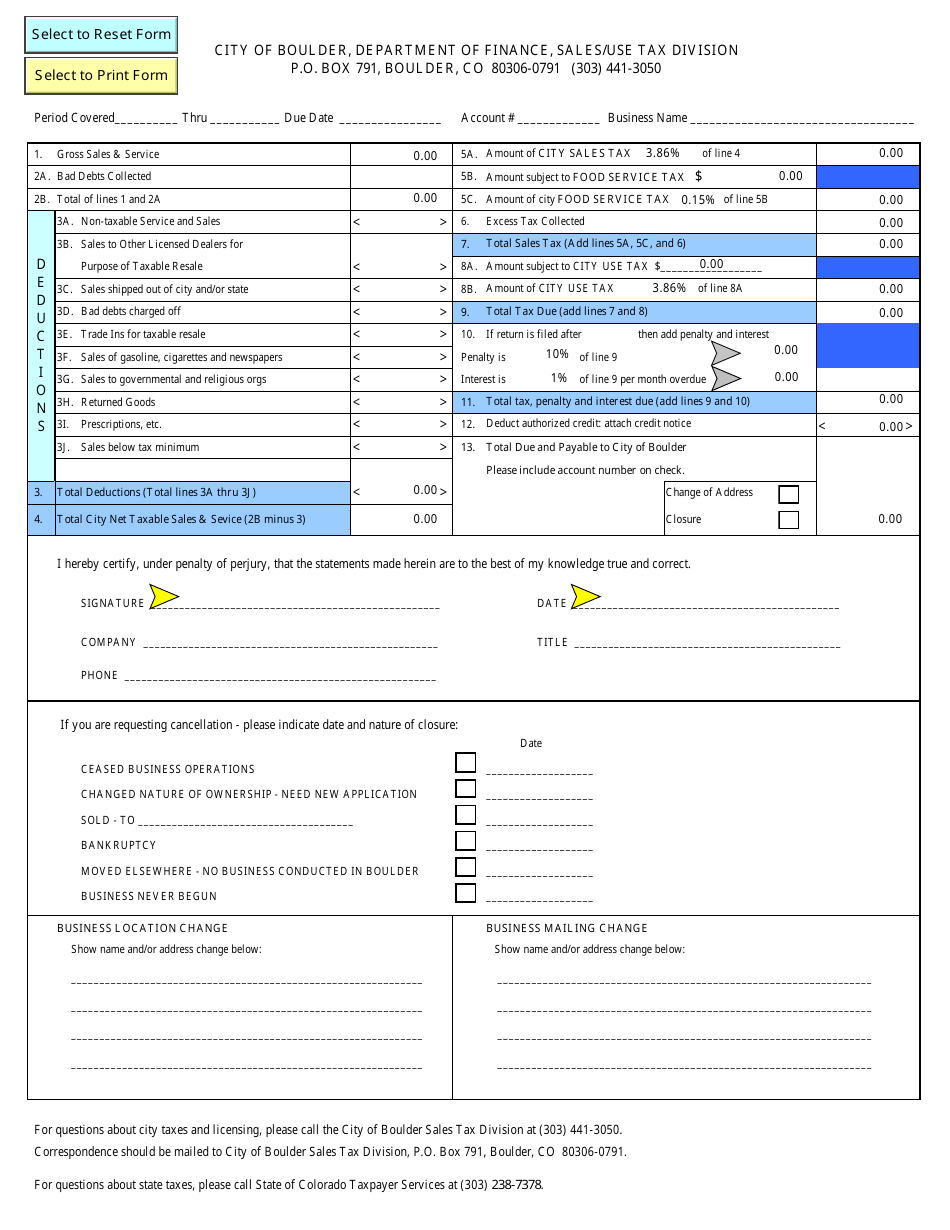

Manage one or many Businesses. Sales 000 of line 4 000 000 5C. Legislation passed in 2008 increases Colorados business personal property tax exemption to 7000 over five years.

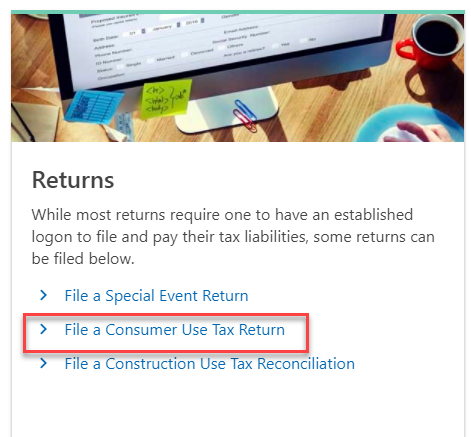

Online Sales Tax Filing. Submit Payment with your tax filing. For additional e-file options for businesses with more than one location see Using an.

Return and payment due on or before January 20th each year. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

Businesses with a sales tax liability of up to 15month or 180year. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City. The minimum combined 2022 sales tax rate for Boulder Colorado is.

From the tax year beginning Jan. Jail improvements and operation. There is no provision for any po rtion to be retained as a vendor fee.

Submit Sales Tax Filing across Jurisdictions. The Colorado state sales tax rate is currently. This is the total of state and county sales tax rates.

The 2018 United States Supreme Court decision in South Dakota v. Our processor charges a fee for card payments. Governor Polis signed HB22-1027 on January 31 2022 which extends the small business exception to destination sourcing requirements.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. City of Longmont 353 State of Colorado 290 RTD 100 Cultural District 010 Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. Property Data.

This is the total of state county and city sales tax rates. Businesses that pay more than 75000 per year in state sales tax. 300 or more per month.

Amount of city FOOD SERVICE TAX 015 of line 5B 6. Remote sellers have the option to file and remit for the City of Brighton through the Colorado Sales and Use Tax System SUTS. Debit cards 1 minimum 100.

How to Apply for a Sales and Use Tax License. Colorado Department of Revenue. If you have more than one business location you must file a separate return in Revenue Online for each location.

City of Boulder Sales Tax Form. The County sales tax rate is. This exception applies only to businesses with less than 100000 in retail sales.

The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. The SUTS portal will allow you to. Online Sales Tax Filing.

Credit cards 25 minimum 395. Sales tax returns must be filed monthly. You can print a 8845 sales tax table here.

This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort. Print records of your previous filings. There are a few ways to e-file sales tax returns.

Monthly returns are due the 20th day of month following reporting period. Businesses with a sales tax liability between 15-300 per month. Boulder County does not have a sales tax licensing requirement as our sales tax is collected by the Colorado Department of Revenue.

The Boulder sales tax rate is. The city use tax rate is the same as the sales tax rate. This tax must be collected in addition to any applicable city and state taxes.

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. Filing frequency is determined by the amount of sales tax collected monthly. Create a User Account.

Sales and Use TaxFinancial Services. Beginning October 1 2022 all retailers will be required to apply the destination sourcing rules. Excess Tax Collected 000 7.

Boulder County has enacted Level 1 Fire Restrictions. File online tax returns with electronic payment options. 1 2015 onward the exemption will be increased biennially to account for inflation.

Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. If you pay with an e-check there is no charge to you for the service. Boulder County Sales Taxes.

Sent direct messages to Sales Tax Staff. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. For tax rates in other cities see Colorado sales taxes by city and county.

Has impacted many state nexus laws and sales tax collection requirements. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers. Non-profit human service agencies.

Complete a Business License application or register for a Special Event License.

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Campus Controller S Office University Of Colorado Boulder

Five Areas Of Focus For Tax Teams As They Look To A Post Covid Future

File Sales Tax Online Department Of Revenue Taxation

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

Consumer Use Tax How To File Online Department Of Revenue Taxation

Filing Your Investment Club Taxes Bivio Investment Clubs

Colorado Tax Resolution Options For Back Taxes Owed

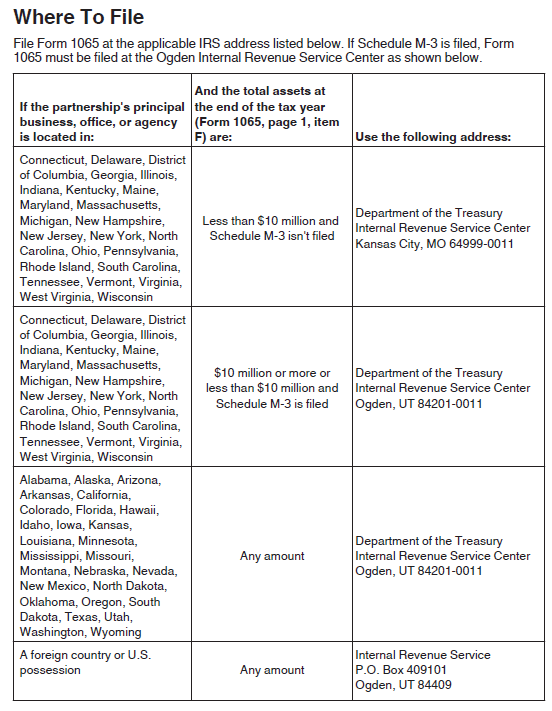

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar